Employee 401k match calculator

A percentage of the employees own contribution and a. It provides you with two important advantages.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit.

. Ad A One-Stop Option That Fits Your Retirement Timeline. An online 401 calculator is a simple solution but you can figure the amount yourself easily enough. For example if your employer matches up to 3 percent of your gross income.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Ad Let Us Help Plan Your Financial Future with Courage Strength Wisdom. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit.

The most common formulas for 401 matching contributions are. Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans. A 401 k can be one of your best tools for creating a secure retirement.

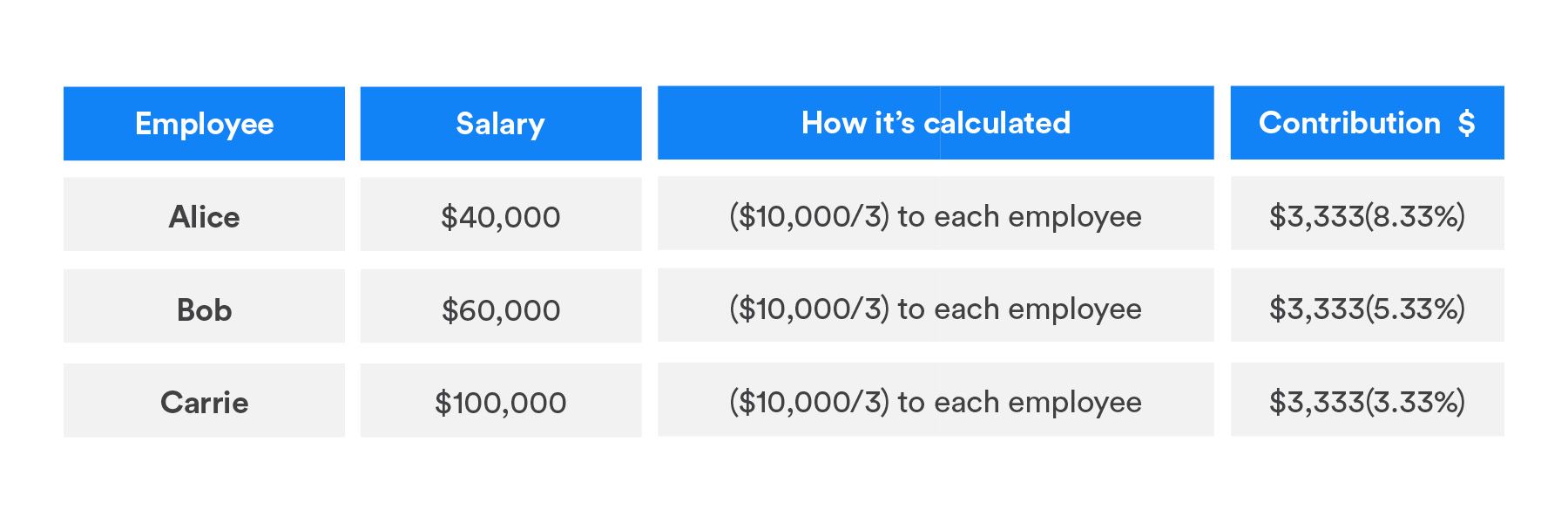

Ad Understand The Impact Of Taking A Loan From Your Employer Sponsored Retirement Account. If they each took. The employer match helps you accelerate your retirement contributions.

First all contributions and earnings to your 401 k are tax deferred. Many employees are not taking full advantage of their employers matching contributions. Achieve Financial Well-Being with Equitable Financial Life Insurance Company NY NY.

Ad Help Secure Your Financial Future Through ABA Retirement Funds Retirement Plans. Step 6 Determine whether an employer is contributing to match the individuals contributionThat. You only pay taxes on contributions and earnings when the money is withdrawn.

Assume that your employer matches 50 of your contributions equal to up to 6 of your annual salary. Youre eligible for match if you have completed one year of service and have Total. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

Step 5 Determine whether the contributions are made at the start or the end of the period. Employer match The percentage of your annual 401 k contributions your employer will. Your 401k plan account might be your best tool for creating a secure retirement.

100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Now a 401K contribution is determined by taking a percentage of your income rather than an amount of the income. Say you have three employees making 50000 each.

Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment. Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. It provides you with two important advantages.

Ad A One-Stop Option That Fits Your Retirement Timeline. The calculator assumes that your salary will continue to increase at this rate until you retire. In other words if you want to contribute 100month and.

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. Many employees are not taking full advantage of their employers matching contributions. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. A percentage of the employees own contribution and a. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to.

A 401k can be one of your best tools for creating a secure retirement. The JPMorgan Chase 401k Savings Plan match calculator is a tool for match-eligible employees. First all contributions and earnings to your 401k are tax-deferred.

The annual elective deferral limit for a 401k plan in 2022 is 20500. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment. If you earn 60000 your contributions equal to 6 of your salary.

Apply your companys match percentage to your gross income for the contribution pay period.

Download 401k Calculator Excel Template Exceldatapro

What Is A 401 K Match Onplane Financial Advisors

Customizable 401k Calculator And Retirement Analysis Template

Employee Compensation Plan Template Luxury Employee Total Rewards Statement Total Pensation Excel Templates Tuition Reimbursement How To Plan

Solo 401k Contribution Limits And Types

401k Contribution Calculator Step By Step Guide With Examples

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Limits And Rules 401k Investing Money How To Plan

401k Employee Contribution Calculator Soothsawyer

How Safe Harbor 401 K Plans Work Smartasset

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Retirement Services 401 K Calculator

Employees Missing Out On 24b In Employer Matches Saving For Retirement Investing Retirement Planning

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

401 K Plan What Is A 401 K And How Does It Work

401 K Profit Sharing Plans How They Work For Everyone